U.S. Labor Market Defies Predictions: A Positive Outcome for Crypto?

Despite predictions, the U.S. labor market outperformed in May, leading to mixed economic interpretations and impacting digital asset markets such as crypto.

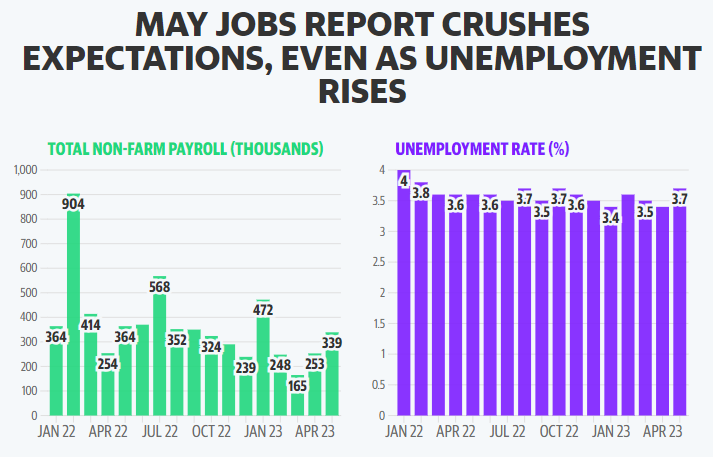

May 2023 came as a surprise for many economists as the U.S. labor market numbers far exceeded the anticipated figures. Instead of the projected 195,000, a whopping 339,000 jobs were created, as per the Bureau of Labor Statistics (BLS) report. For 14 consecutive months, job creation has consistently surpassed Wall Street forecasts, reflecting a resilient labor market, capable of surprising even seasoned economists. This continued positive trend led to an upward surge in stocks, with investors optimistic about a potential delay in the Federal Reserve’s anticipated interest rate hikes.

Analysts on Unemployment Rate and Wage Growth

While the employment numbers were certainly encouraging, the unemployment rate saw a slight increase to 3.7%. Additionally, the growth rate of hourly wages decelerated marginally from 4.4% in April to 4.3% in May. While some experts interpret this as the Federal Reserve finding a suitable equilibrium in the job market, others have been taken aback by these figures. Experts are split between praising the resilience of the U.S labor market and expressing concern over the potential implications of the slight uptick in unemployment and slower wage growth.

US Payroll & Unemployment Rate. Source: Bureau of Labor Statistics

Speculation on Potential Interest Rate Hikes: An In-depth Perspective

Amidst this robust job growth, speculation about potential interest rate hikes remains. The strength in nonfarm payrolls keeps the door open for a possible rate increase in June, especially if the consumer price index (CPI) report, due on June 13, shows positive results. However, Sarah House from Wells Fargo suggests that the slowed wage growth trend signifies a gradual cooling in the labor market, potentially influencing future interest rate decisions. On the other hand, some economists believe that despite potential mild downturns caused by these hikes, the labor market’s strength indicates a resilience that remains largely unaffected by these fluctuations.

Interpreting The Job Market Indicators

Interpretations of the job market indicators have been mixed among economic experts. Paul Ashworth from Capital Economics believes that the substantial increase in May’s non-farm payroll employment might overshadow other aspects of the report. For instance, he points out the significant decrease in the household survey measure of employment, which drove the unemployment rate up. Contrarily, Christopher Rupkey from FWDBONDS downplays the unemployment rate increase, suggesting the labor market and the economy are strong.

Recession Possibility Amid Economic Strength

While the U.S. economy shows continued strength in employment, the threat of a potential recession still lingers. Kathy Bostjancic from Nationwide stresses that if the economy continues to be ‘too hot’ and fails to slow inflation, the Federal Reserve could respond by raising rates higher, creating a path that could lead to an economic downturn. Moreover, other experts note that, despite the seemingly strong job market, households have reported significant job losses.

Wage Growth and Unemployment Trends

In terms of wage growth, Nancy Vanden Houten and Ryan Sweet from Oxford Economics highlight that current wage growth is still quite far from the Federal Reserve’s 2% inflation target. The minor decrease in the prime-age employment-to-population ratio provides another measure of labor market tightness, despite its position above the threshold historically associated with full employment.

Digital Assets React to Job Market Data Amid Lawsuits

Crypto markets have shown resilience in the face of ongoing SEC lawsuits against major platforms Binance and Coinbase.

Even as these legal challenges unfold, digital asset markets such as the crypto market have found some respite in the form of labor market data. Initial jobless claims have seen an uptick, indicating potential weakening in the labor market and more FUD for crypto. However, this could imply that the Federal Reserve’s efforts to temper inflation are taking effect, making a pause in interest rate hikes more likely, which could prove positive for digital asset prices.

Impact of Jobs Data on Digital Assets

The global crypto market sentiment, as measured by the fear and greed index, remains neutral despite all these developments. However, there have been significant regional shifts in bitcoin trading activity, with the U.S. witnessing an 11% drop since mid-2022 and Asian markets seeing a corresponding increase. This geographic shift implies that regulatory stances may not affect the demand for digital assets but rather the location where such transactions occur. As digital assets continue to gain popularity, these developments will play a critical role in shaping the future of the market.

This wide-ranging analysis provides a comprehensive understanding of the complexities and dynamics of the U.S. labor market, economic forecasts, and the impact on digital asset markets. The overarching narrative reveals a resilient economy capable of surprising experts and defying predictions, yet still presenting numerous questions about future trajectories and impacts.

Comments are closed.