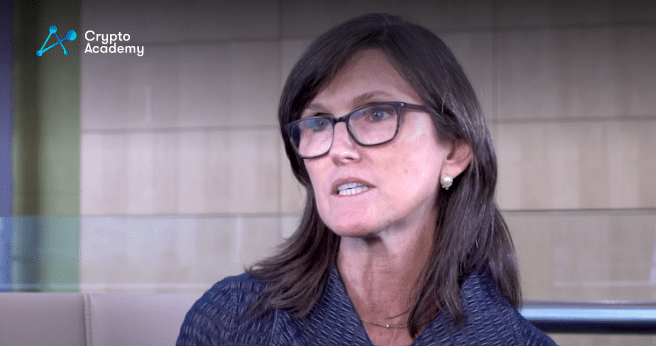

Cathie Wood Compares Bitcoin and Ether To Gold

Cathie Wood, CEO of ARK Invest, has likened Bitcoin and Ether to gold. Wood suggested that they function as “flight to safety” assets in current times as we face macroeconomic uncertainty. She believes that recent events show the need for a more secure and stable store of value. According to her, Bitcoin and Ether can provide both.

Wood’s comments came after the recent banking crises. The recent collapses of Silicon Valley Bank and Credit Suisse have highlighted the need for a more secure and stable store of value. In a recent podcast, Wood stated that “Bitcoin is a flight to safety like gold.” She suggested Bitcoin can function in a similar way to gold when the global economy is uncertain.

The CEO of ARK Invest also stated that recent statistics show that Bitcoin can outperform traditional assets. According to her beliefs, broader adoption of Bitcoin is on the horizon. Throughout the podcast, Wood mentioned that Bitcoin and Ether will become an election issue. Of course, she did not fail to mention the mounting regulatory pressures on the crypto industry.

These comments from Cathie Wood come after rumors spread that the Governor of Florida is looking to initiate a plan to implement cryptocurrencies in the banking system. This move would be significant for the cryptocurrency industry, especially Bitcoin.

In a press release, Wood kept endorsing Bitcoin even more. She stated that Bitcoin has acted like a risk-off asset during periods of uncertainty throughout the past decade. This leaves investors with the idea that they should turn to Bitcoin as a way to preserve their wealth. When compared to stocks and hedge funds in the market, Bitcoin has outperformed all of them since 2008. So, because of this, Wood classifies Bitcoin as one of the only “assets” that could protect investors from market volatility.

ARK Invest’s Research Estimates Bitcoin To $1 Million

Recently, ARK Invest published Bitcoin estimates for the years to follow. According to the research, Bitcoin could reach a price of approx. $400,000 on a bearish note. On a bullish note, however, BTC could be trading at a price of $1.48 million. Considering how major ARK Invest is, these estimates suggest that Bitcoin’s future is full of potential, and possibly, new milestones.

Bitcoin has been compared to gold since its debut. This is because these two assets share some similarities. Both Bitcoin and gold are seen as a hedge against inflation and as assets that act as a good store of value. However, Bitcoin has numerous advantages over gold. The first advantage is that no one can freeze or access your account besides yourself. The second major advantage is the digital nature of Bitcoin. While moving huge amounts of gold from one place to another can be hard, transferring BTC is always easy.

Comments are closed.