Bipartisan Push in US Congress Challenges SEC New Crypto Asset Rule, SAB 121

Key figures in the United States Congress, including Senators Cynthia Lummis, Kirsten Gillibrand, and Representatives Patrick McHenry, French Hill, Ritchie Torres, Mike Flood, and Wiley Nickel, have united to challenge the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 (SAB 121). This rare alliance across party lines centers on a significant issue: the SEC’s directive for banks to report customers’ crypto assets on their balance sheets. This mandate, they argue, unfairly singles out crypto holdings compared to other assets, potentially dampening banks’ willingness to act as custodians for cryptocurrencies.

Amidst this debate, the group has reached out to key financial authorities, calling for a reassessment and clarification of SAB 121. This action follows a critical finding by the Government Accountability Office (GAO), which adds weight to their concerns.

Congressional Scrutiny and Regulatory Overreach Fears

The GAO’s involvement originated from Senator Lummis’s request to the U.S. Comptroller General in August 2022, leading to an evaluation of whether SAB 121 qualifies as a ‘rule’ under the Congressional Review Act. This act requires any agency rule to undergo a thorough review process, involving both chambers of Congress, with a provision for Congressional disapproval.

Congress members fear that implementing SAB 121 without adhering to this protocol could set a precedent allowing regulatory bodies like the SEC to extend their influence inappropriately, potentially bypassing the Administrative Procedure Act and other established legislative processes.

Industry Reaction and the Future of Crypto Regulation

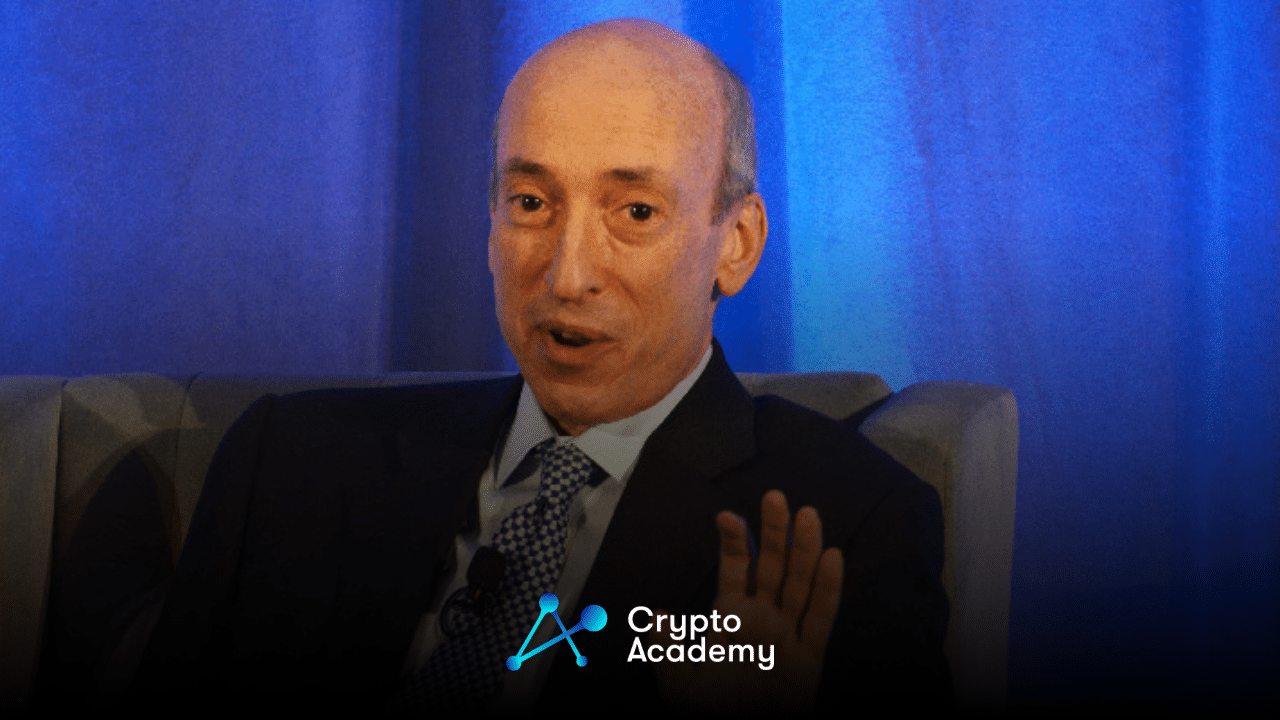

The concern over SAB 121 extends beyond Capitol Hill. In June 2022, a group of five senators communicated their apprehensions about this ‘backdoor regulation’ to SEC Chair Gary Gensler. Representative Mike Flood also expressed his opposition to the bulletin during Gensler’s testimony before the House Financial Services Committee in September.

This collective pushback from legislators mirrors a broader sentiment in the financial and cryptocurrency sectors against regulations perceived as overreaching or vague. The challenge against SAB 121 marks a crucial juncture in the ongoing conversation between regulatory entities and the digital asset industry.

Is Crypto Regulation Anywhere Near?

As the debate over SAB 121 unfolds, it raises a compelling question: What does the future hold for crypto regulation in the United States? This standoff between Congress and the SEC over SAB 121 reflects a broader tension between innovation and regulation. How will this balance evolve, and what will be the impact on the dynamic cryptocurrency market? As regulators and legislators grapple with these complex issues, the answers they find could shape the trajectory of digital finance for years to come.

Comments are closed.