BTC Miners Are Selling Moderately. Technicals Point to a Trend Reversal. Top Losers

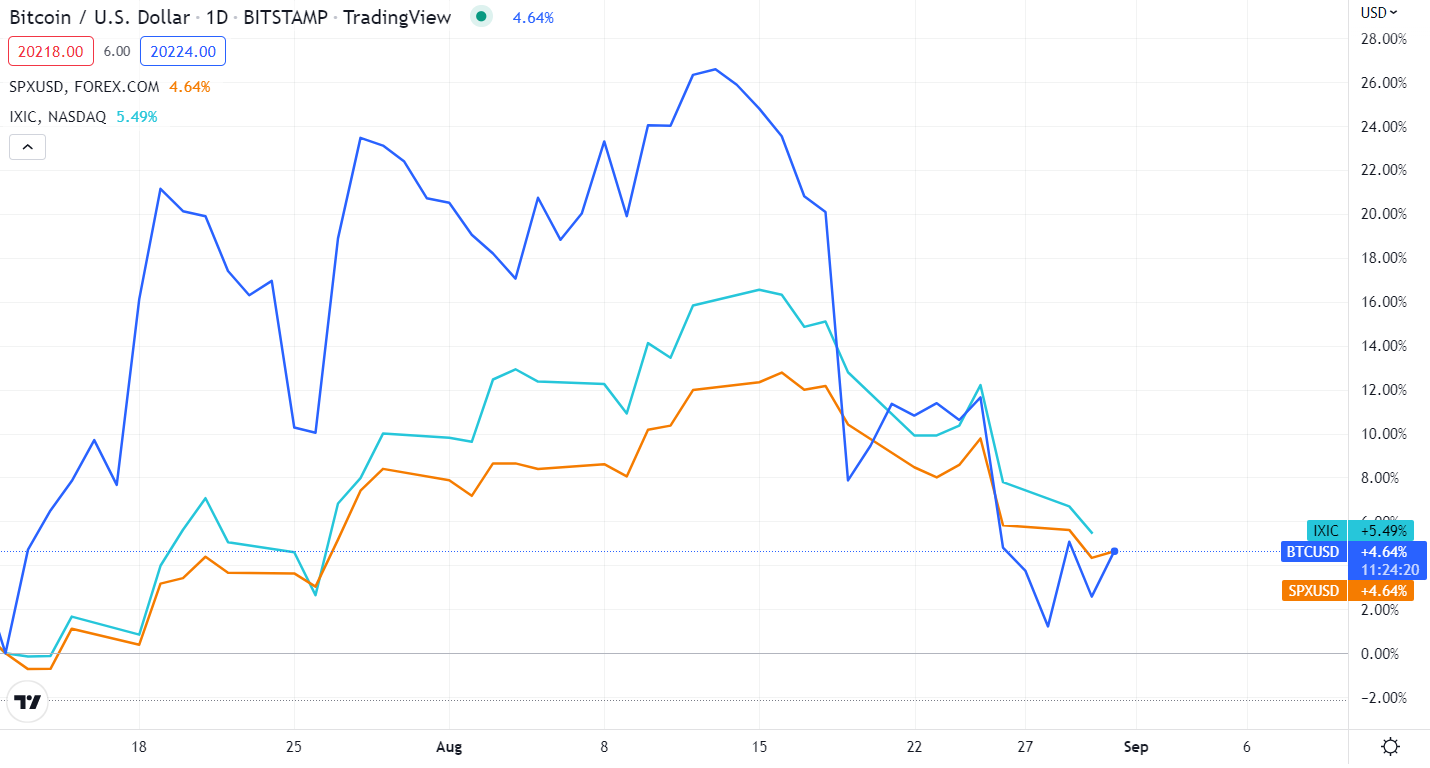

All markets dropped following the central bank’s Jackson Hole economic symposium on Friday, with the Nasdaq down almost 4%, the S&P 500 losing 3%, and Bitcoin falling 6% for the day as well.

Source: TradingView

Powell reaffirmed the Federal Reserve’s commitment to curb inflation, stating that the Fed will continue to raise interest rates at a pace that will have “some pain” for the US economy.

As for inflation, he said it is still near its highest level in more than 40 years, and that the bank will use its tools forcefully to combat it.

In spite of some investors’ hopes for a future dovish shift, many analysts, including myself, expected the Fed chairman to adopt a hawkish tone and reiterate the central bank’s commitment to bringing inflation back on track. As for the latter, it is unlikely that it will happen anytime soon, nor does Bitcoin appear to stop copying stocks.

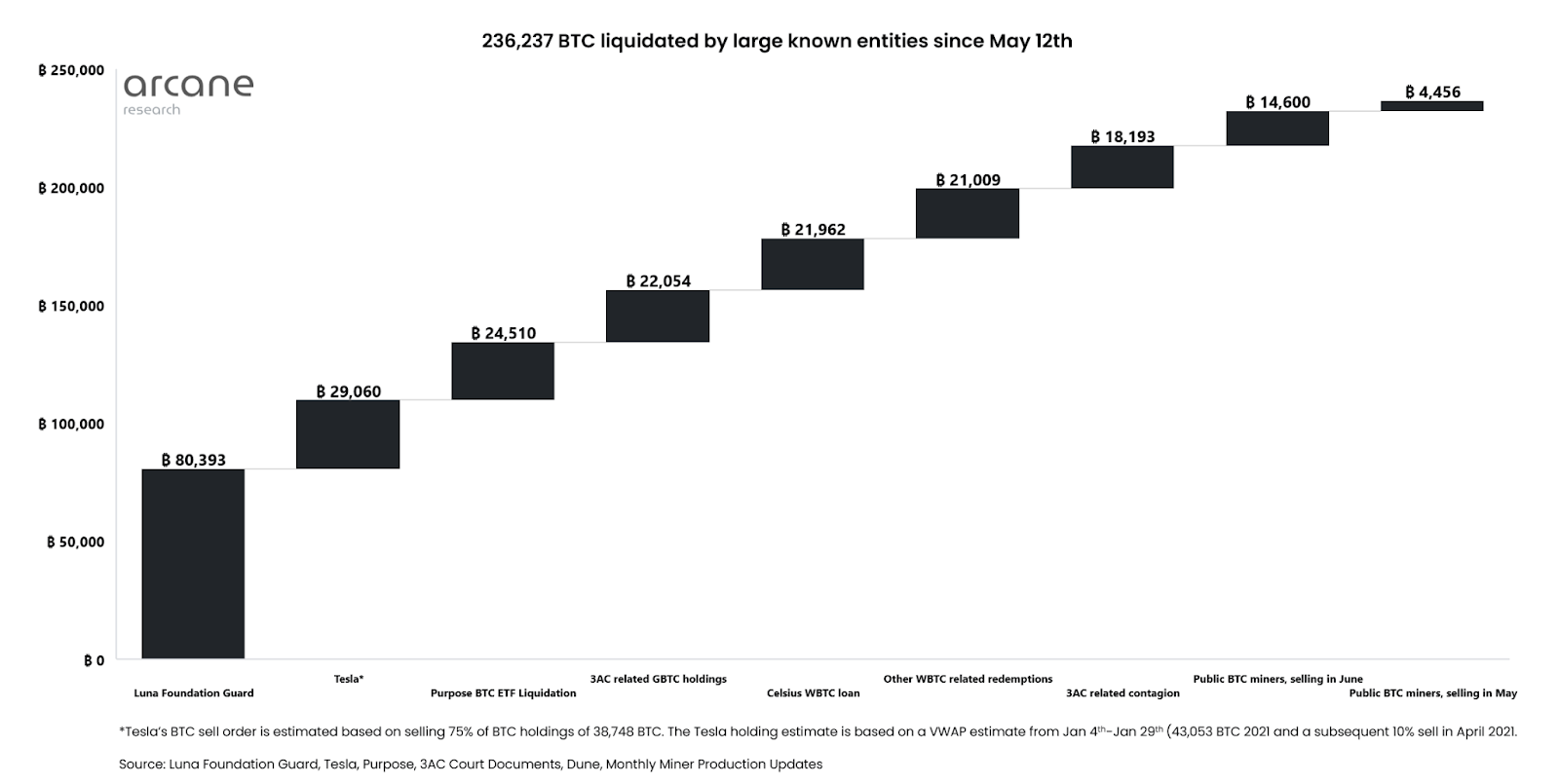

Bitcoin Miners’ Selling Pressure Is Waning

It is true that Bitcoin miners are liquidating their holdings, but not to the extent they did during the early summer mining bloodbath when major entities dumped around 240,000 BTC.

Source

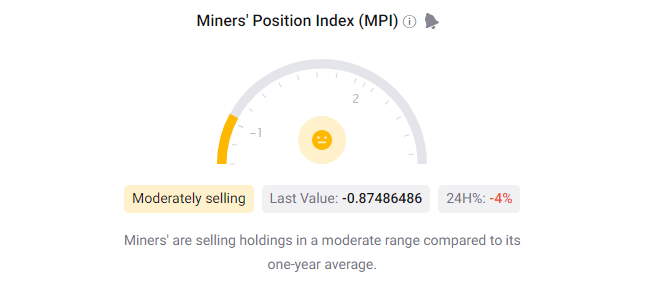

BTC price rebounded and gained 17% in July, explaining the reduction in public miners’ selling pressure. Since June’s forced selling, miners have reduced their selling and some have even accumulated. As of yet, it is too early to declare this a bullish sign.

Source: Cryptoquant.com

On the technical side, both RSI and Stochastic show an oversold condition in the last two weeks where 71% of price movement has been downwards, which suggests that the trend may be reversing.

Source: TradingView

The Worst-Performing Cryptos

Taking a look at the cryptos that had a rough time recently, the following can be highlighted.

apM Coin (APM)

apM Coin is the native cryptocurrency of a blockchain-based customer reward management and payment platform designed to improve wholesaler-to-buyer trading efficiency and credibility.

In early August, Binance.US delisted the asset after the SEC cited APM as an unregistered security during its investigation of Coinbase’s insider trading. With a market cap of $23.01 million at the time of writing, it fell 47.7% over the past two weeks. APM reached its all-time low of $0.00944614 on Jun 14, 2022.

Source: Messari.io

Sportium (SPRT)

Sportium is an official multi-sports NFT platform that enables users to interact with sports through collecting, trading, playing, and earning. The token’s market value, which sits at $39.3 million, has decreased 30.8% in two weeks. It is 93.8% below its all-time high of $3.75 reached on March 1, 2022.

Source: Messari.io

Everdome (DOME)

Everdome is a metaverse within the Metahero ecosystem. The goal of Everdome is to create an ubiquitous web3 experience by using hyper-realistic graphics. DOME, its native token, is, however, suffering from side winds and has dropped 52.4% in two weeks, reaching an all-time low on August 31 at $0.00191389.

Source: Messari.io

P.S. Originally this article was published on CoinTelegraph

Image source: pexels.com

Comments are closed.