Bitcoin & Ethereum – Safe Havens for Institutions

Bybit’s report reveals institutions favored Bitcoin and Ethereum as safe havens amid 2022’s volatile crypto market.

In the volatile financial landscape of 2022, Bybit’s latest report sheds light on the shifting dynamics in cryptocurrency investment, particularly focusing on Bitcoin and Ethereum. The exchange’s comprehensive analysis delves into the strategies adopted by various investor groups – institutions, high-net-worth individuals, and retail investors – amidst the market’s volatility, marked by events such as Terra’s downfall and FTX’s dramatic implosion.

Institutional Strategies Amidst Market Volatility

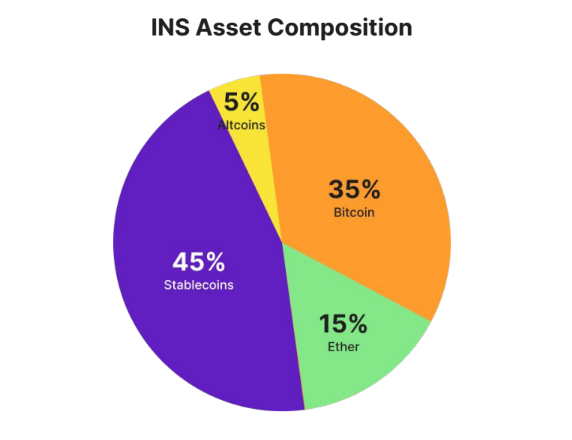

Institutional investors, as per Bybit’s findings, displayed a strong preference for Bitcoin and Ethereum as safe havens, allocating half of their portfolios to these two cryptocurrencies. This trend highlights their role as safe havens during times of market uncertainty. Interestingly, these investors held 45% of their crypto assets in stablecoins, leveraging them as a volatility buffer while strategically reinvesting in Bitcoin and Ethereum during more optimistic market phases.

This approach underscores the agility of institutional players in maneuvering through market fluctuations, capitalizing on short-term opportunities while safeguarding their investments against sudden market downturns. In contrast, retail investors maintained higher proportions in stablecoins, directing most of their other investments towards more speculative assets.

Retail vs. Institutional Crypto Holdings

A striking divergence appeared in September when institutional investors significantly increased their Bitcoin holdings, responding to transient improvements in market sentiment. Retail investors, however, remained cautious, barely altering their minimal year-to-date Bitcoin investments. This period saw institutional players reaping benefits from market upturns, while retail investors faced the brunt of forced liquidations.

The report further reveals that alongside their stablecoin reserves, institutional investors consistently held a combined 50% of their portfolios in Bitcoin and Ethereum. This trend continued even amidst fluctuating interest in Ethereum, especially around the time of Ethereum’s major Merge upgrade. Post-Merge, the interest in Ethereum varied, with a noted drop in ETH holdings across most trader categories, despite its stable price performance post-Shapella.

Stablecoin Trends and Market Insights

Retail investors tend to decrease their stablecoin holdings during bullish markets, a trend that reverses in uncertain or bearish conditions. Institutional investors, on the other hand, exhibit more strategic timing, reducing stablecoin holdings in bear markets and increasing them when the market is bullish. September saw a noteworthy decline in stablecoin holdings, coinciding with a rise in Bitcoin and Ethereum investments.

As of the report’s release, Bitcoin and Ethereum have witnessed substantial growth compared to the last 18–19 months. Bitcoin, for instance, has seen a 144% increase year-to-date, reaching a high of over $42,000 before stabilizing around $41,508. Ethereum, similarly, has surged by 76.2% year-to-date, recently surpassing the $2,200 mark.

While these developments signal a potential upturn, the cryptocurrency market’s inherent unpredictability leaves open the question of whether this marks the start of a new bull market or is merely a temporary rally in response to speculative events, such as the anticipation of a Bitcoin ETF.

Comments are closed.