Binance Responds to Reuters Claims About Mixing User Funds

In a recent article published by Reuters, allegations were made against Binance, the world’s largest cryptocurrency exchange, suggesting that the company had mixed billions of dollars worth of customer assets with its corporate revenue during the years 2020 and 2021. These actions were said to have obscured the whereabouts of the funds in question, raising concerns about the transparency and regulatory compliance of the exchange.

Binance’s Chief Communications Officer, Patrick Hillmann, responded to the claims, dismissing the report as “weak” and displaying elements of xenophobia. However, he did acknowledge that the exchange had faced regulatory shortcomings in the past.

Reuters Claims

The Reuters report relied on information provided by anonymous sources familiar with the matter, including one individual who claimed to have direct knowledge of Binance’s group finances. According to this source, the comingling of funds occurred regularly in accounts held by Binance with Silvergate, a crypto-supportive bank that has itself faced investigation for its involvement in fund comingling.

Binance refuted the allegations, stating that the funds held in its Silvergate accounts were not customer deposits but rather funds used to purchase BUSD, the exchange’s native dollar-pegged stablecoin. However, there was some confusion regarding the representation of dollar transfers on Binance’s website, which referred to them as “deposits” that would be “credited” as BUSD to users’ accounts. This raised concerns about the clarity of regulatory safeguards surrounding these transfers.

Paxos, the issuer behind BUSD, faced regulatory scrutiny as well, and in February of this year, it was forced to halt the issuance of new stablecoin tokens following a Wells Notice from US regulators.

In response to the Reuters article, Binance’s Hillmann took to Twitter, emphasizing that customers were explicitly informed on the website that their deposits would be used to purchase BUSD. He criticized Reuters for claiming that there was no evidence of Binance clients losing money, considering it an attempt to protect themselves from a potential libel suit.

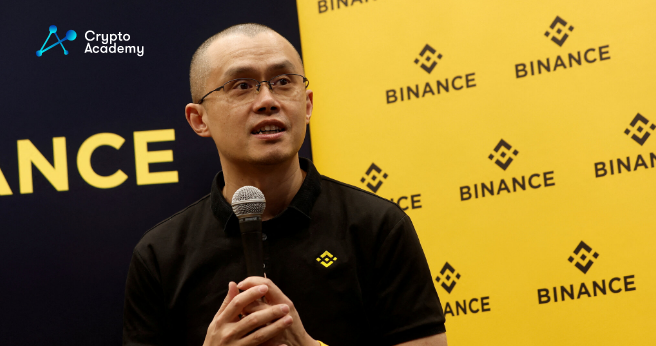

Moreover, Hillmann accused Reuters of implicit xenophobia, pointing out the frequent mention of Binance’s CEO Changpeng Zhao’s Chinese ethnicity. He clarified that Binance is not a Chinese company and emphasized that he has been a Canadian citizen since the age of 12.

Comments are closed.