Report Suggests US Treasury Is At Risk Of Running Out Of Funds

The US Congressional Budget Office (CBO) has recently published a report suggesting a significant risk of the US government failing to meet all its financial obligations. The report states that this could happen as early as June. This potential risk is a consequence of the country reaching its statutory debt limit of $31.4 trillion in January. Experts state that if this goes unaddressed, it could plunge the country into a debt crisis.

The CBO’s report, released on May 12, paints a worrying picture of the US government’s fiscal health. If the statutory debt limit remains unchanged, the country could face serious financial challenges by June.

“…there is a significant risk that at some point in the first two weeks of June, the government will no longer be able to pay all of its obligations.”

US Congressional Budget Office

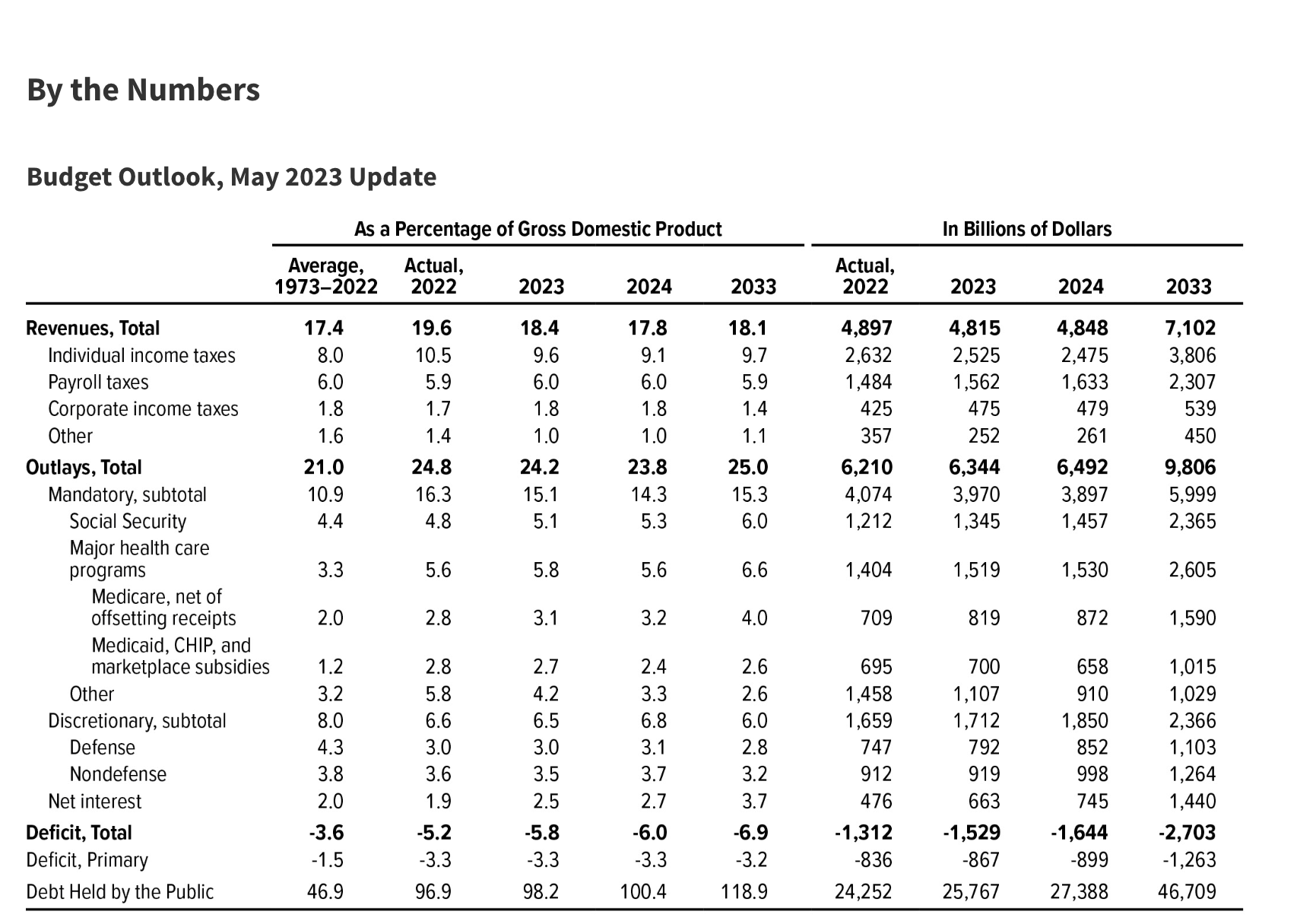

According to the projections, the federal budget deficit for 2023 is expected to be $1.5 trillion. This would mark a staggering $100 billion increase from the initial estimations made in February. The organization attributes this potential increase to a shortfall in tax receipts recorded through April. Moreover, the organization also points out the uncertainty surrounding the ongoing Supreme Court case concerning the cancellation of outstanding student loan debt. This could significantly impact total revenue for 2023.

The situation is further complicated by the CBO’s long-term projections. The office anticipates that the annual deficits will almost double over the next decade. If this happens, it would reach an astronomical $2.7 trillion in 2033. This trend, if unaltered, will result in an unprecedented level of national debt.

“As a result of those deficits, debt held by the public also increases in CBO’s projections, from 98 percent of GDP at the end of this year to 119 percent at the end of 2033 — which would be the highest level of U.S debt ever recorded…”

US Congressional Budget Office Report

Projections Could Be Fatal For The Global Economy

These projections put the US government in a precarious position. If the country defaults on its debt, it could trigger a cascading effect. This would then potentially undermine the stability of the global financial system. As the world’s largest economy, the US plays a crucial role in the global financial landscape. One misstep could lead to another, and many missteps have the potential to shake the global financial landscape heavily.

The CBO’s report underscores the need for smart fiscal management and reforms to mitigate the risk of a debt crisis. It calls for a reevaluation of the current fiscal policy and a commitment to sustainable economic growth. Policymakers must now maneuver through these tough realities and make difficult decisions to steer the nation clear of this looming financial crisis.

These findings also raise important questions about the role of cryptocurrency in the global financial system. As governments grapple with increasing debt, decentralized digital assets could offer an alternative for individuals and businesses. However, the volatility and regulatory challenges associated with cryptocurrencies also need to be addressed for them to become viable financial instrument in these uncertain times.

Comments are closed.