Biden Administration Restricts Communications Director’s Crypto Involvement

The Biden administration restricts Communications Director Ben LaBolt’s involvement with former crypto clients while allowing him to advise on crypto regulations.

New information indicates that the Biden administration is imposing restrictions on Communications Director Ben LaBolt’s involvement with matters related to his previous crypto and technology clients. These limitations follow the recent release of a public financial disclosure report, which highlighted LaBolt’s past connections to major players in the crypto and tech sectors, such as decentralized exchange Uniswap and venture capital powerhouse Andressen Horowitz.

Although the White House is implementing these constraints, LaBolt will still be permitted to provide guidance on cryptocurrency and social media company regulations. The imposed limitations align with ethical guidelines adhered to by other high-ranking White House personnel.

LaBolt’s Former Connections and Restrictions

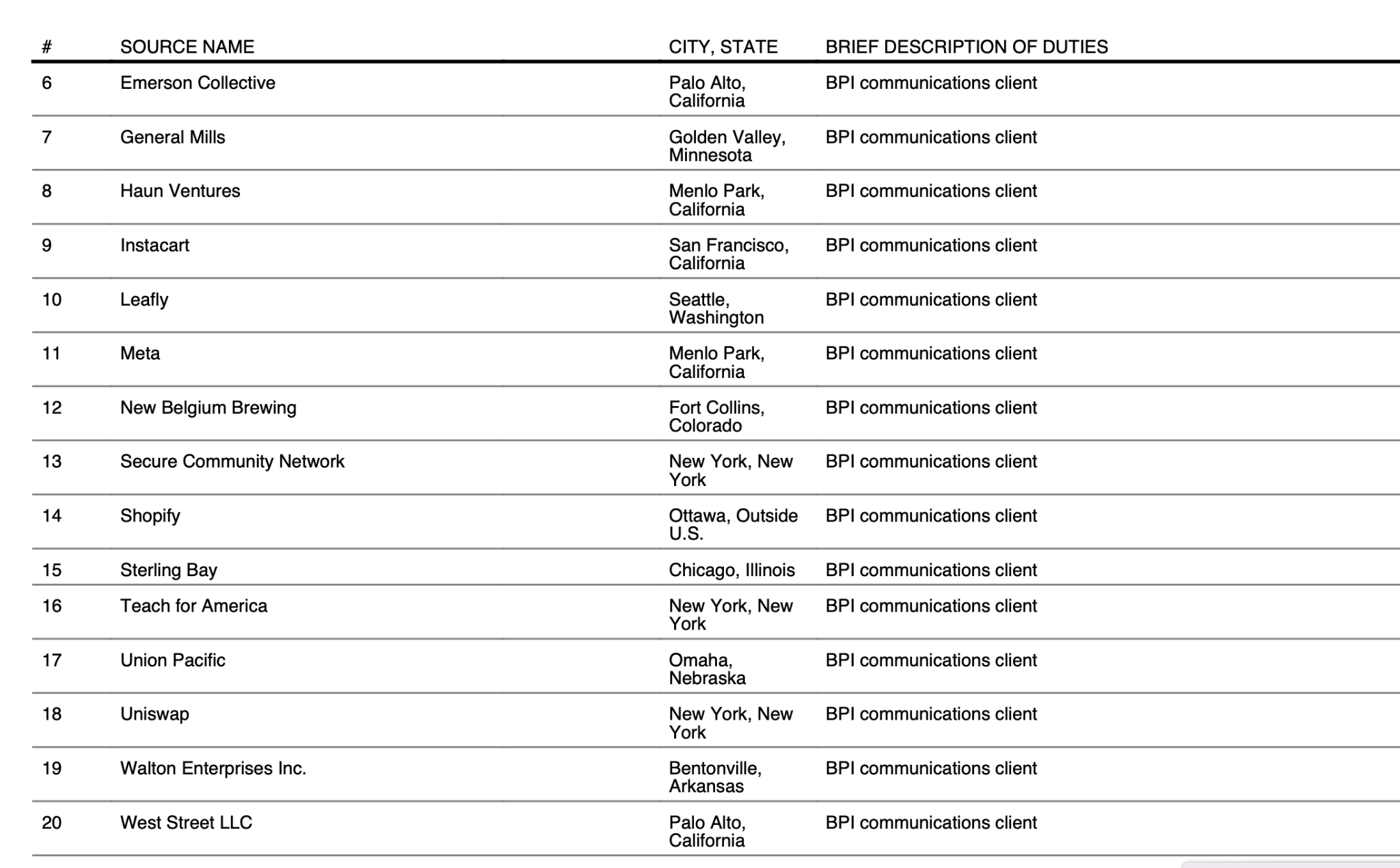

A Bloomberg Law article published on April 21 states that LaBolt will be prohibited from engaging in legal affairs, investigations, or contractual dealings with cryptocurrency or technology firms he represented in the past. Prior to joining the Biden administration, LaBolt was a partner at Bully Pulpit Interactive (BPI), a company that worked with Uniswap and Andressen Horowitz. These two firms were part of a group of 23 clients who paid BPI annual fees exceeding $5,000.

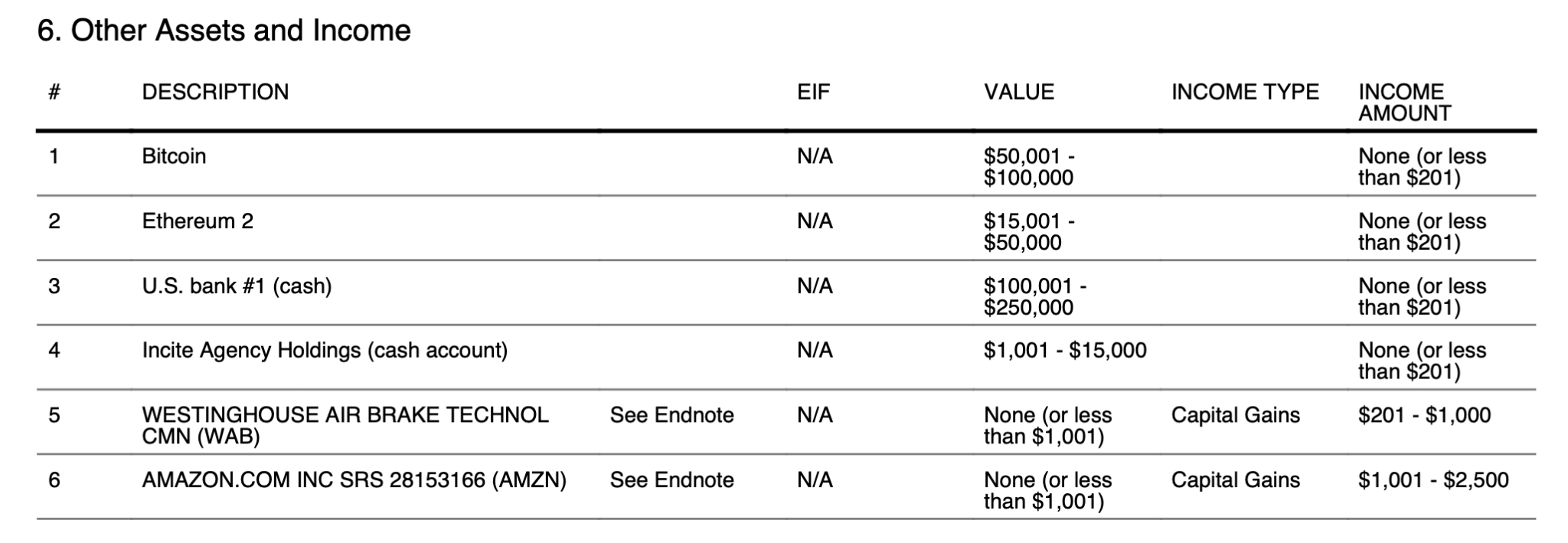

BPI’s additional high-profile clients included Meta Platforms, Shopify, and West Street, the family office of Meta’s CEO, Mark Zuckerberg, and his wife, Priscilla Chan. In the financial disclosure report’s assets and income section, LaBolt disclosed his ownership of Bitcoin valued between $50,001 and $100,000 and Ethereum 2 (ETH2) worth $15,001 to $50,000.

LaBolt’s Role in Cryptocurrency Regulation

Despite the imposed restrictions on LaBolt’s interactions with former clients, the White House will allow him to counsel President Biden on regulatory approaches for cryptocurrencies and social media firms. This development follows the president’s signing of an executive order on digital assets on March 9. While the order did not explicitly specify regulatory measures, it initiated an interagency collaboration process involving 16 top-level officials.

The responsibility of these officials is to generate a comprehensive series of reports addressing various aspects of digital asset regulation. The deadlines for these reports range from 90 days to over a year after the executive order’s issuance. The presidential directive has garnered the attention of government representatives and industry leaders.

Wyoming’s Republican “Crypto Senator” Cynthia Loomis praised the Biden administration for demonstrating an increasing interest in digital assets. Additionally, Ari Redborn, head of legal and government affairs at blockchain-focused intelligence firm TRM Labs, voiced his pleasant surprise at the unexpectedly positive tone of the executive order.

By implementing these restrictions, the Biden administration aims to uphold ethical standards while capitalizing on LaBolt’s knowledge in the rapidly advancing domain of cryptocurrency regulation.

Comments are closed.